My Life in WordsLHC - THE STORIES OF HOSPITALITY

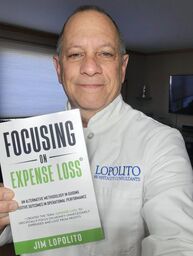

Jim Lopolito

Lopolito Hospitality Consultants, Corp. (LHC) is a New York based consulting firm that offers Recovery Facilitation, Startup Development, Feasibility Studies, and Forward-Thinking Solutions alongside Operational and Management Practices to businesses in the hospitality industry. Jim Lopolito, President of Lopolito Hospitality Consultants, Corp. is a veteran of the restaurant, country club, catering & concert industries offering expert assistance with club management consulting, restaurant consulting, and other foodservice development. He has worked as an executive chef and general manager and has performed in a consulting role for more than 20 years. His proprietary “Expense Loss Review” program has been a highly sought after resource for his broad client base. |

PAYCHECK PROTECTION PROGRAM & UNEMPLOYMENT BENEFITS QUANDARIES ( A COVID TIMEFRAME REPORT)4/19/2020 The Paycheck Protection Program was touted as protection to your business. Although there is a small percentage of these loans that actually reached restaurants and similar food service businesses, there are downfalls to prepare for with the program.

The current unemployment benefits program is supporting both regular benefit income, along with a $600 added supplement. This supplement, for as long as this continues, will act to discourage a return to employment influence. Employees are far less likely to be encouraged to return to employment under these pay programs.Use the following thoughts in preparation for your company’s near future planning. With or without receiving the PPP loan funds, businesses will run into a brick wall hiring back employees. In most cases, you will be offering to pay less than the unemployment benefits staff is receiving by not working. Unemployment benefits with the extra $600 per week are considerably higher than most foodservice personnel are currently earning. With PPP and the 8 weeks spend guideline it will be difficult to bring back all employees during this timeframe, therefore you will be required to pay back the loans in two years. This will further burden your businesses' cash flow. With this consideration; 1) As long as the unemployment benefits include the extra $600 per week hospitality companies will have difficulty in getting staff to return if offering usual wages. 2) Companies that attempt to use 75% of the PPP loan mandate to pay wages will encounter two scenarios. a) Staff will not return to work because they are earning more with unemployment, therefore the company will fall short of the 100% hire back requirement. b) Companies that do achieve the 100% hire back requirement will complete the 8 weeks and not have enough business to support keeping 100% staff on payroll, therefore laying them off again. 3) Companies will begin considering alternate methods of payroll if they need staff, therefore supplementing the unemployment income. Other factors to consider;

Overall, if you are not planning your business scenarios for the coming months you will find yourself cut short of your potential along with a higher risk of failure ahead of you.

0 Comments

Leave a Reply. |